ONBOARDING

Conversational Loan Application

Year

2018

Company

SOFI

Role

Product Design

Objective

SoFi Personal Loans offer fast access to credit intended to empower, not burden, responsible borrowers. However, the existing application experience was outdated and complex particularly on mobile, where conversion rates consistently underperformed compared to desktop.

Previous Experience

The previous funnel had no clear insight into drop-off points. The application was lengthy and difficult to complete on mobile, and much of the internal review process remained manual, which led to slow time-to-fund and avoidable errors. We saw a clear opportunity to improve conversion by streamlining the user journey and reducing friction.

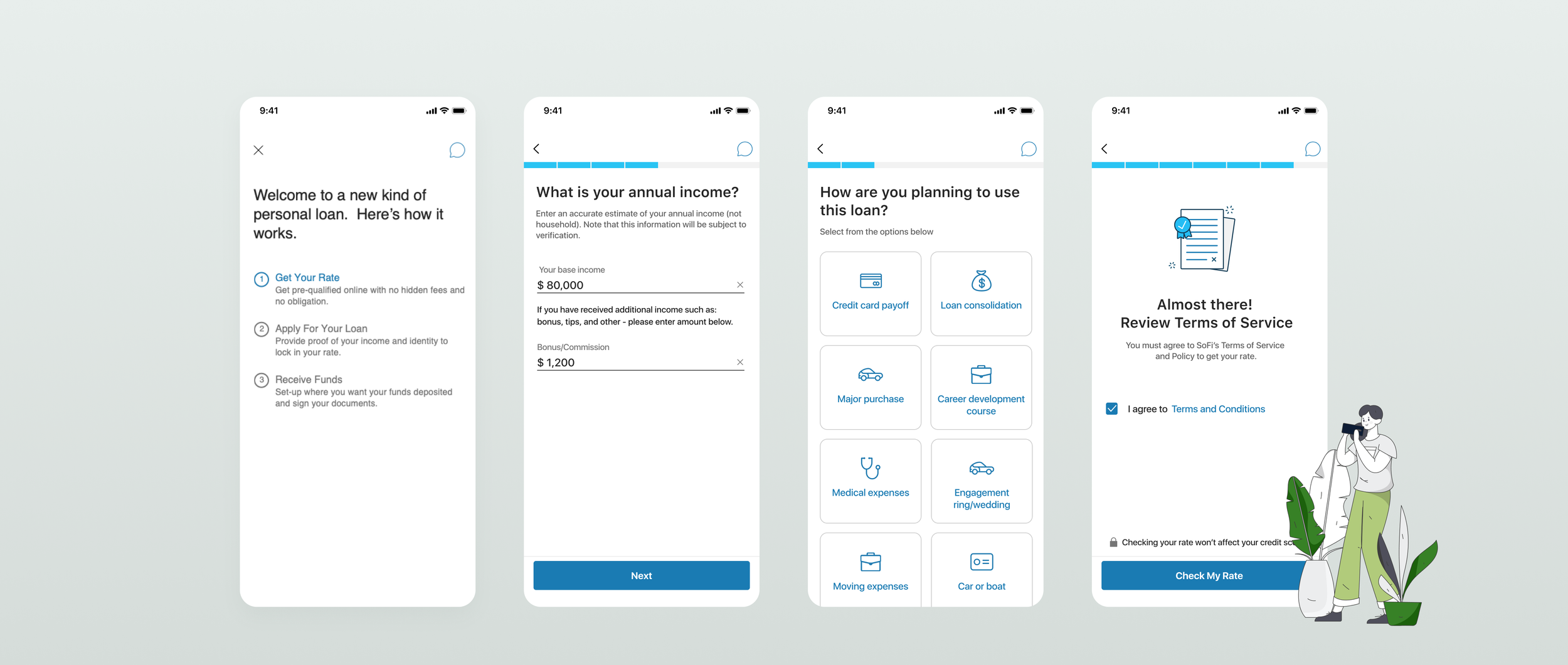

Conversational Onboarding

I redesigned the experience around a step-by-step conversational approach. Instead of overwhelming users with a long form, I broke the flow into smaller, focused questions transforming 25 fields into just 9 thoughtfully designed inputs. Interactive moments helped set expectations, offer guidance, and celebrate progress along the way.

Pre-approval Experience

To speed up applications, we used pre-filled data where possible and replaced dropdowns with quick, tappable options. This simplified format reduced input fatigue and made the mobile experience faster and more intuitive.

Smart Verification Logic

Introduced intelligent branching to surface only relevant identity and income document requests based on a user’s input eliminating unnecessary steps. The system also surfaced personalized product recommendations to match user goals.

Responsive Layout

Designed for mobile-first, the layout used bite-sized questions, a visual progress bar, and contextual help to keep users oriented. A live chat option was embedded directly in the flow, giving applicants instant access to support if they hit friction.

Outcome

By redesigning the onboarding flow into a dynamic, conversational experience and embedding smart logic and support tools, we transformed a burdensome process into a guided journey one that was faster, more personalized, and measurably more effective for both users and the business.

30% lift in start-to-fund conversion after launch of the new Personal Loan 2.0

35% increase in funded loan volume and revenue

Reduced cost-per-funded loan, driven by fewer errors and faster document processing

Increased retention and engagement thanks to a clearer, faster, and more tailored experience